Coyyn: Redefining Digital Payments with Innovation and Security

In today’s fast-paced digital era, the need for efficient, secure, and user-friendly financial systems is greater than ever. One platform making significant waves in this space is Coyyn. Designed to revolutionize how people handle digital payments, Coyyn introduces a fresh approach to financial transactions by leveraging cutting-edge technology and decentralization principles.

What is Coyyn?

Coyyn is an emerging digital payment ecosystem built to provide secure, fast, and borderless transactions. Unlike traditional payment gateways, Coyyn is decentralized, offering users more control over their finances. Its foundation lies in blockchain technology, ensuring transparency, lower costs, and top-tier security.

From peer-to-peer transfers to global remittances, Coyyn is shaping the future of how money moves across borders efficiently and reliably.

Why Coyyn Stands Out

1. Decentralized Architecture

eliminates the need for middlemen such as banks or third-party processors. This not only reduces fees but also enhances transaction speed and security. Its blockchain infrastructure supports a trustless system, where every transaction is validated by the network, not a central authority.

2. Speed and Efficiency

Whether you’re transferring funds locally or internationally, ensures your transactions are processed almost instantly. Its high-performance protocol significantly reduces wait times associated with traditional banking systems.

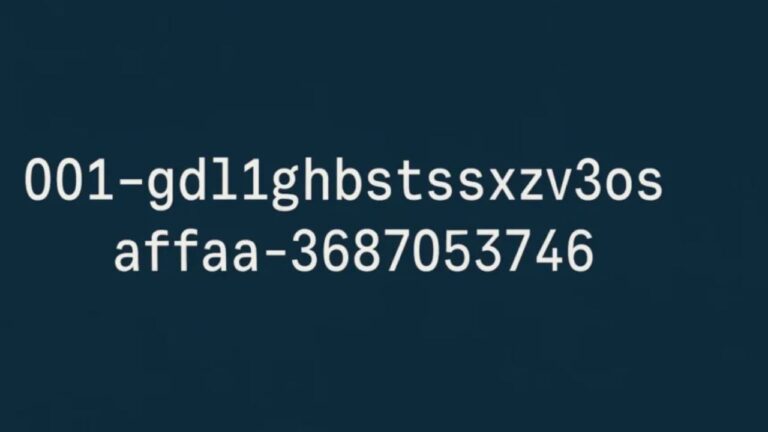

3. Strong Privacy Features

Privacy is a major concern in digital finance. Coyyn addresses this with advanced encryption and zero-knowledge proof mechanisms, protecting user identities and transaction details without compromising functionality.

Coyyn in Everyday Use

a. For Individuals

Coyyn makes it simple to send and receive funds globally. Whether it’s paying a friend, making a donation, or sending money to family abroad, Coyyn offers an affordable and secure way to transfer funds.

b. For Businesses

Small and large businesses can benefit from Coyyn’s low transaction fees and global reach. It offers tools for invoicing, tracking payments, and integrating with online platforms.

c. For Freelancers

Global freelancers often struggle with high fees and slow bank transfers. Coyyn provides an excellent alternative, allowing them to receive payments from clients around the world quickly and affordably.

Key Features of Coyyn

1. Cross-Border Capabilities

Coyyn allows seamless international transactions without the need for currency conversion or banking approvals. This is especially valuable in developing countries and regions with limited financial access.

2. User-Friendly Wallet

The Coyyn wallet is intuitive and supports various digital assets. It provides real-time balance updates, transaction history, and advanced security options like 2FA and biometric logins.

3. Scalability

Coyyn’s blockchain is built to handle a large volume of transactions without slowing down. As more users join the platform, its performance remains stable and reliable.

Comparing Coyyn to Traditional Systems

When compared to traditional payment processors, Coyyn offers several advantages:

| Feature | Coyyn | Traditional Systems |

|---|---|---|

| Speed | Instant | 1–5 Business Days |

| Fees | Low | High |

| Decentralization | Yes | No |

| User Privacy | High | Low to Medium |

| Accessibility | Global | Region-Dependent |

Coyyn clearly offers a more user-centered approach, prioritizing efficiency, privacy, and cost-effectiveness.

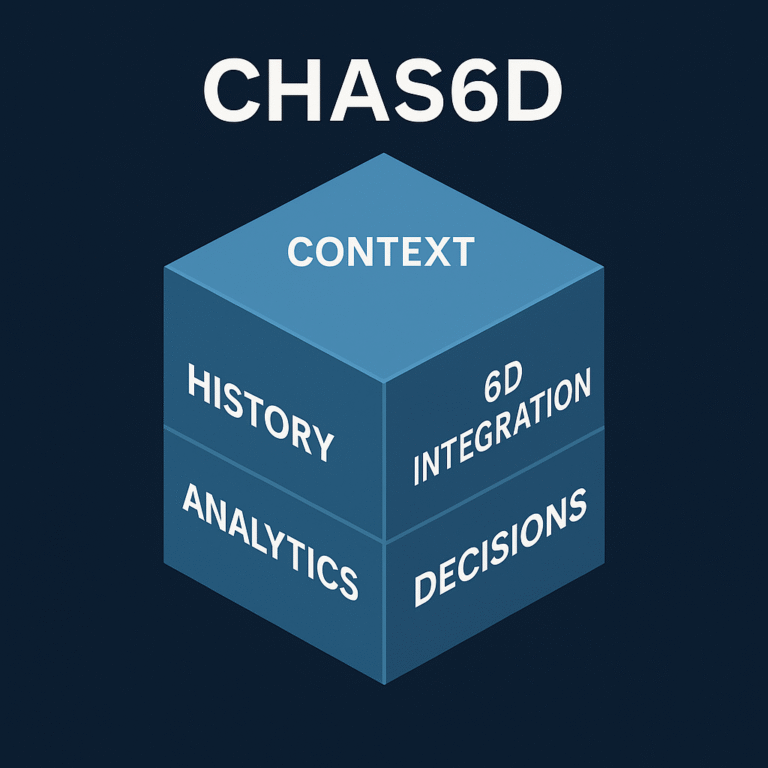

The Technology Powering Coyyn

Coyyn runs on a secure blockchain network using a Proof-of-Stake (PoS) consensus mechanism. This system is energy-efficient and encourages users to participate by staking their tokens to help validate transactions.

In addition, Coyyn supports smart contracts, which automate agreements and processes without needing intermediaries. This opens the door for Coyyn to integrate with decentralized applications (dApps) and further expand its ecosystem.

Security at the Core of Coyyn

Coyyn prioritizes the safety of its users. Every transaction is encrypted and recorded on an immutable ledger. With robust identity protection and anti-fraud systems in place, users can trust Coyyn to keep their assets secure.

Regular audits and a transparent development team ensure that the platform stays up to date with industry best practices and compliance standards.

The Future of Coyyn

Coyyn’s roadmap includes exciting upcoming features like:

-

Mobile App Integration

-

Merchant Tools for Online Stores

-

API Access for Developers

-

Partnerships with Global Financial Institutions

With a strong vision and an active user base, Coyyn is poised to become a leader in the digital payments sector.

Community and Adoption

it has been growing steadily, with communities forming across forums, social media, and developer networks. The platform’s open communication with users and commitment to innovation helps build trust and foster long-term engagement.

Many users have reported significant savings and improved user experiences since switching to Coyyn for their daily transactions.

Conclusion: Coyyn is the Future of Payments

As the global economy becomes increasingly digital, platforms like are not just innovative—they are essential. By offering fast, secure, and affordable transactions, it is helping individuals and businesses take control of their finances.

Whether you’re tired of bank delays, high fees, or privacy concerns, its provides a compelling alternative. It’s not just a payment platform; it’s a revolution in how we think about money and financial freedom.